Rrsp Limit For 2024 – Additionally, any gains made in an RRSP are also tax-deferred, so you only pay tax on funds when they are withdrawn. Keep in mind that because RRSPs have so many tax-related benefits, they do have an . For years, Registered Retirement Savings Plans (RRSPs) have been touted as the best way for Canadians to save money for the future. But with other government-registered savings accounts now available, .

Rrsp Limit For 2024

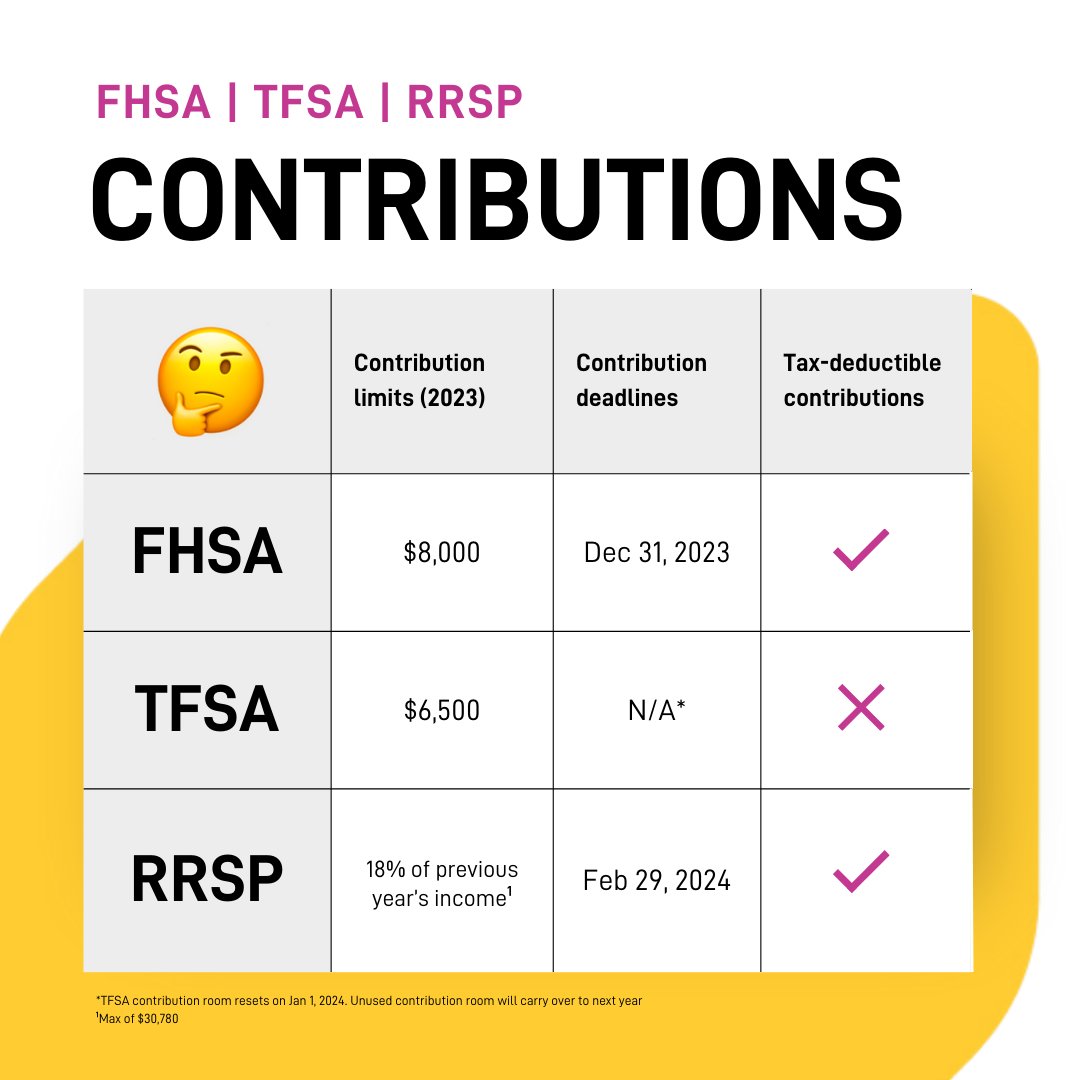

Source : m.facebook.comWhat is the Maximum RRSP Contribution for 2024

Source : www.canadianlic.comEQ Bank on X: “Optimize your money’s potential—be in the know of

Source : twitter.comOptimize your money’s potential—be in the know of important dates

Source : www.instagram.comThree key considerations for RRSP season 2024 | Harvest ETFs

Source : harvestportfolios.comChanges to RRSP Contribution Limits in 2024

Source : taxaccountantidm.comSAVE & Deprez & Associates Private Wealth Management | Facebook

Source : m.facebook.comRRSP Contribution Deadline for 2024 – Forbes Advisor Canada

Source : www.forbes.comRRSP Dollar Limit for 2024 | ETFs

Source : harvestportfolios.comImportant Powell and Associates Private Wealth Management

Source : m.facebook.comRrsp Limit For 2024 Polish Credit Union The 2023 RRSP deadline is February 29, 2024 : When an RRSP contribution is made, there’s no requirement to claim the deduction that year. If you’re expecting your salary to increase significantly in the next couple years, you could maximize tax . Between 2020 to 2022, employees were allowed to claim $2 per day for every day they worked from home, up to a maximum of $500. Now, employees will be required to tally up and prorate their expenses .

]]>