Fsa Allowed Expenses 2024 – Both an HSA and a flexible spending account (FSA) are tax-advantaged accounts designed to help you save money for medical expenses. The same medical expenses are eligible for coverage with HSAs . For full details, start with IRS Publication 969, which explains how qualified medical expenses are those specified in an employer’s FSA plan that with FSAs are allowed to roll over unspent .

Fsa Allowed Expenses 2024

Source : www.thebossysauce.comFlexible Spending Accounts 2024 | Beverly, MA

Source : www.beverlyma.govFlexible Spending

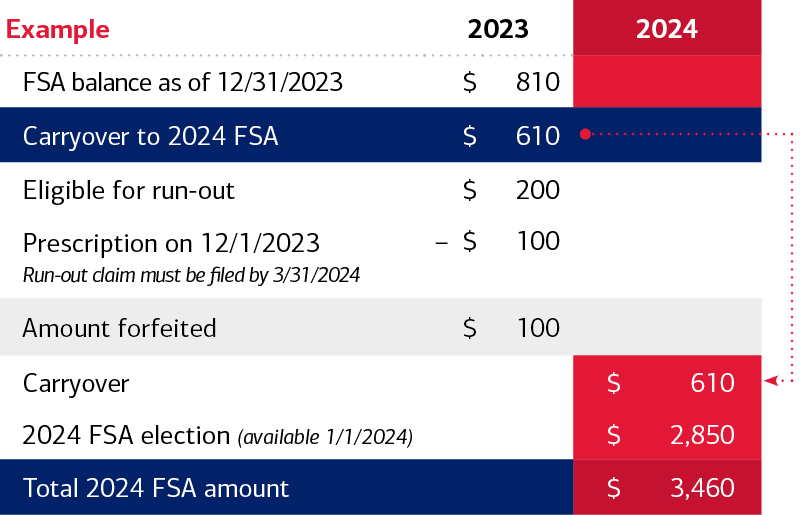

Source : www.trinity-health.orgUnderstanding the year end spending rules for your health account

Source : healthaccounts.bankofamerica.comFlexible Spending Accounts 2024 | Beverly, MA

Source : www.beverlyma.govHSA Eligible Expenses in 2023 and 2024 that Qualify for

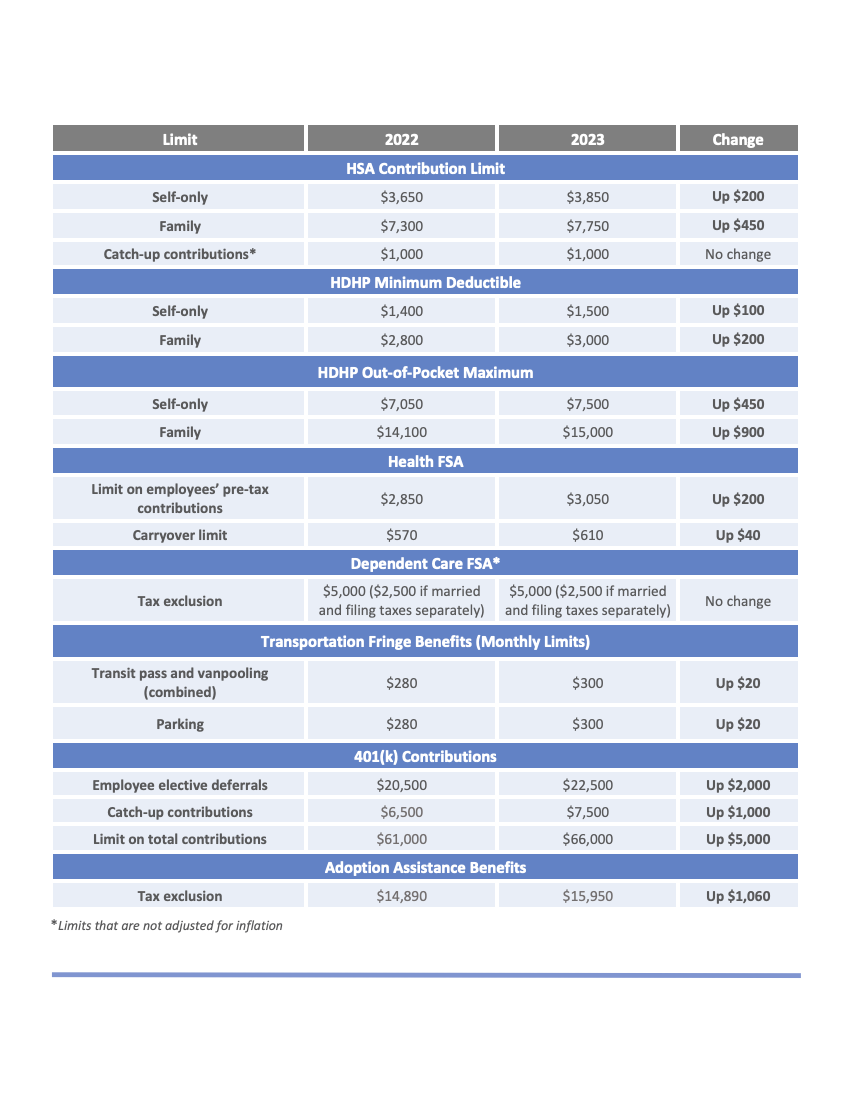

Source : www.fool.comFlexible Spending Account contribution limits to increase in 2024

Source : www.govexec.com2024 FSA Eligible Items & Where To Buy | MetLife

Source : www.metlife.comFSA HSA Contribution Limits for 2023

Source : stratus.hr63 FSA Eligible Items to Buy Before Your Funds Expire

Source : www.healthline.comFsa Allowed Expenses 2024 24 Coolest Wellness & Gadget FSA Finds / HSA Items in 2024; From a : Alternatively, they can allow up to 20% of the maximum allowed contribution to can still spend it on qualified medical expenses. The savings on an FSA contribution depend on how much you . With an FSA, this is allowed regardless of whether or not they are on your health insurance plan. Keep in mind that if you do use funds for your dependents’ medical expenses, they must be .

]]>